In today’s fast-paced financial world, staying ahead of the curve is crucial for investors looking to maximize their returns. Enter Fintechzoom SP500, a cutting-edge platform that’s transforming how investors approach the S&P 500 index.

This powerful tool combines real-time data, comprehensive analytics, and user-friendly features to give both novice and experienced investors an edge in navigating the complex world of U.S. stocks.

Key Points: Unleashing the Power of Fintechzoom SP500

Before we dive deep into the intricacies of Fintechzoom SP500 and its impact on investment strategies, let’s highlight the key points that make this platform a game-changer:

- Real-time data access: Stay up-to-date with the latest market movements in the S&P 500.

- Comprehensive analytics: Gain deeper insights into stock performance and market trends.

- User-friendly interface: Navigate complex financial data with ease, regardless of your experience level.

- Customizable tools: Tailor your investment approach to your unique goals and risk tolerance.

- Educational resources: Continuously improve your financial literacy and investment skills.

By leveraging these features, investors can develop more informed, data-driven strategies for investing in the S&P 500, potentially leading to better long-term returns.

Understanding the SP500: The Backbone of US Investing

What Is SP500?

The S&P 500, short for Standard & Poor’s 500, is more than just a number flashing across ticker screens on Wall Street. It’s a powerful barometer of the U.S. economy and a key benchmark for investors worldwide.

Comprising 500 of the largest publicly traded companies in the United States, the S&P 500 represents about 80% of the total U.S. stock market capitalization.

Unlike its older cousin, the Dow Jones Industrial Average (DJIA), which includes only 30 stocks, the S&P 500 provides a broader, more comprehensive view of the American economy.

It includes giants like Apple, Microsoft, Amazon, and Johnson & Johnson, spanning sectors from technology and healthcare to consumer goods and industrial manufacturing.

The History of SP500: A Journey Through American Economic Growth

The story of the S&P 500 is, in many ways, the story of modern American capitalism. Its roots trace back to 1923 when Standard & Poor’s introduced its first stock market indicator.

However, the S&P 500 as we know it today was launched on March 4, 1957. Since then, it has become the go-to index for investors, financial analysts, and economists looking to gauge the health of the U.S. economy.

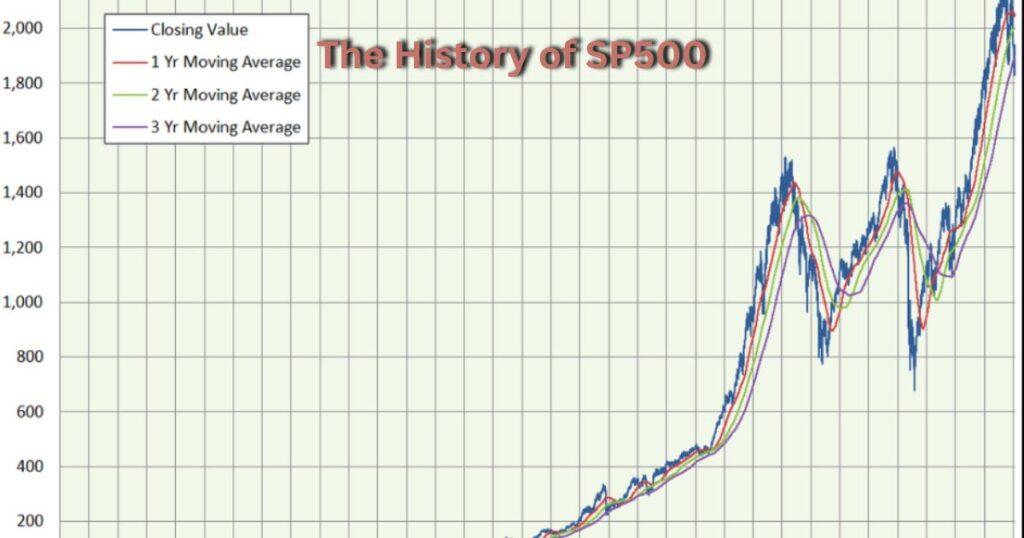

Over the decades, the S&P 500 has witnessed and reflected major economic events:

- The tech boom of the 1990s

- The dot-com bubble burst in 2000

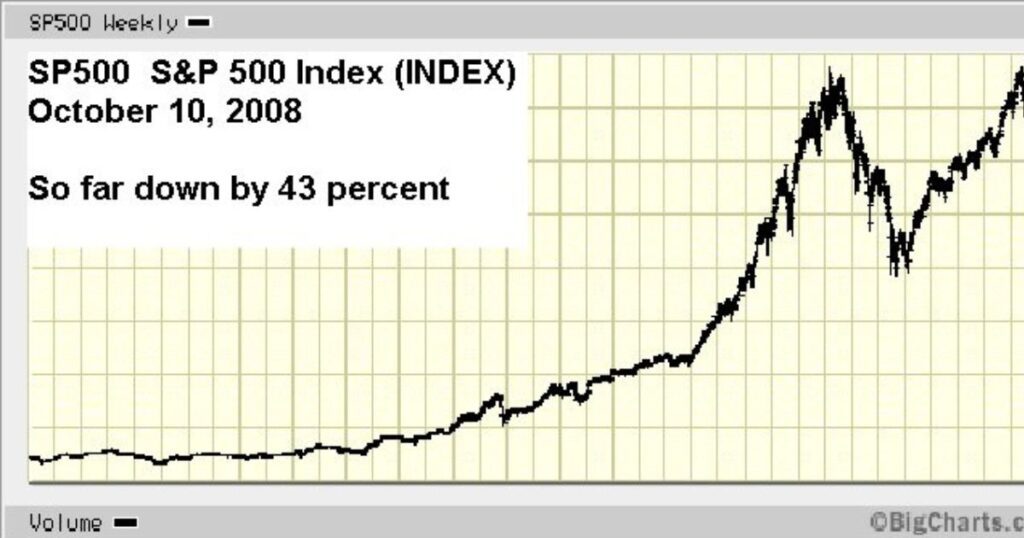

- The financial crisis of 2008

- The longest bull market in U.S. history from 2009 to 2020

- The rapid COVID-19 crash and subsequent recovery

Each of these events has shaped the index, influencing its composition and performance, and providing valuable lessons for investors.

Historical Returns and Economic Ups and Downs of SP500

One of the most compelling aspects of the S&P 500 is its long-term performance. Despite periods of volatility and economic downturns, the index has demonstrated remarkable resilience and growth over time. Let’s look at some key figures:

- Average annual return (1957-2023): Approximately 10.26%

- Best year: 1954 with a return of 52.56%

- Worst year: 2008 with a loss of 38.49%

These figures illustrate an important lesson for investors: while short-term fluctuations can be dramatic, the long-term trend of the S&P 500 has been consistently upward. This historical performance underpins many long-term investment strategies, from retirement planning to wealth accumulation.

However, it’s crucial to remember that past performance doesn’t guarantee future results. The S&P 500’s journey has been marked by periods of both exhilarating growth and nail-biting declines.

Understanding these cycles is key to developing a robust investment strategy, which is where tools like Fintechzoom SP500 come into play.

Diving into the SP500 Index: A Who’s Who of Corporate America

Top Companies Currently Included in the SP 500 Index

The S&P 500 reads like a who’s who of American business, featuring some of the most innovative, profitable, and influential companies in the world. Let’s break down the index by some key sectors:

1) Technology Giants

The tech sector has become increasingly dominant in the S&P 500, reflecting the digital transformation of the economy. Key players include:

- Apple: The world’s most valuable company, known for its iPhones, Macs, and growing services business.

- Microsoft: A leader in software, cloud computing, and enterprise solutions.

- Alphabet (Google): Dominating internet search and online advertising, while investing in cutting-edge technologies.

- Amazon: E-commerce giant that has expanded into cloud computing, streaming, and more.

2) Financial Institutions

Banks and financial services companies play a crucial role in the S&P 500, reflecting their importance to the overall economy:

- JPMorgan Chase: The largest bank in the U.S. by assets.

- Bank of America: A leader in retail banking and wealth management.

- Visa: The world’s largest payment processor.

3) Healthcare Leaders

Healthcare companies in the S&P 500 range from pharmaceutical giants to health insurers:

- Johnson & Johnson: Known for consumer health products, pharmaceuticals, and medical devices.

- UnitedHealth Group: The largest health insurer in the United States.

4) Consumer Goods and Services

These companies produce the products and services that Americans use every day:

- Procter & Gamble: A consumer goods giant with brands in home care, personal care, and more.

- Walmart: The world’s largest retailer, with a growing e-commerce presence.

- Coca-Cola: A beverage industry leader with a global footprint.

Read This Post: White Oak Global Advisors Lawsuit Settlement

5) Industrial Giants

Industrial companies in the S&P 500 represent America’s manufacturing and infrastructure sectors:

- Boeing: A leader in aerospace and defense.

- 3M: Diversified technology company known for innovation across multiple industries.

- Caterpillar: The world’s leading manufacturer of construction and mining equipment.

Standards for Selecting Companies in the SP 500 Index

The S&P 500 isn’t just a list of the 500 largest U.S. companies. Standard & Poor’s has specific criteria for inclusion, ensuring that the index represents the broader U.S. economy:

- Market Capitalization: Companies must have a market cap of at least $14.5 billion. This figure is adjusted over time to reflect overall market conditions.

- Liquidity: Stocks must be sufficiently liquid, with a certain number of shares traded each month.

- Financial Viability: Companies must have positive earnings in the most recent quarter and over the past four quarters in total.

- Sector Representation: The index aims to maintain a balance across different sectors of the economy.

- Corporate Governance: Companies must adhere to certain standards of corporate governance and transparency.

- US Domicile: While not all companies must be U.S.-based, they must have significant operations in the United States.

These criteria ensure that the S&P 500 remains a robust and representative measure of the U.S. economy, making it a valuable tool for investors and analysts alike.

Fintechzoom SP500: Your Investment Ally in Navigating the S&P 500

What Is the Relation Between SP500 and Fintechzoom?

Fintechzoom SP500 is not just another financial data provider. It’s a comprehensive platform designed to help investors make sense of the vast amount of data generated by the S&P 500. By combining real-time market data, advanced analytics, and user-friendly tools, Fintechzoom SP500 aims to democratize access to sophisticated investment strategies.

Here’s how Fintechzoom SP500 relates to the S&P 500:

- Data Aggregation: Fintechzoom SP500 collects and organizes vast amounts of data related to the S&P 500 companies.

- Analysis: The platform provides tools to analyze this data, helping investors identify trends and opportunities.

- Visualization: Complex data is transformed into easy-to-understand charts and graphs.

- Education: Fintechzoom SP500 offers resources to help investors understand the S&P 500 and develop effective investment strategies.

Impact of Financial Companies on SP500

The financial sector, including traditional banks and fintech companies, plays a significant role in the S&P 500. As of 2023, financial companies make up about 13% of the index. This sector’s performance can have a substantial impact on the overall index, as we saw during the 2008 financial crisis.

Fintech companies, in particular, are reshaping the financial landscape. While many aren’t yet large enough to be included in the S&P 500, their influence is growing.

Companies like Square (now Block) and PayPal are challenging traditional financial institutions, potentially changing the composition of the S&P 500 in the future.

Fintechzoom SP500 helps investors navigate these changes by providing:

- Detailed analysis of financial sector performance

- Insights into emerging fintech trends

- Tools to assess the impact of financial sector developments on other parts of the S&P 500

Leveraging Fintechzoom SP500 for Smarter Investing

Services Provided by Fintechzoom S&P 500

Fintechzoom SP500 offers a suite of services designed to give investors a comprehensive view of the S&P 500:

- Real-Time Data on SP500: Stay ahead of market movements with up-to-the-minute price data, trading volumes, and more.

- Made for Different Investment Styles: Whether you’re a day trader or a long-term value investor, Fintechzoom SP500 has tools tailored to your approach.

- Clear Market Understanding: Complex market dynamics are broken down into easily digestible insights.

- Comprehensive Analytics: Dive deep into company financials, sector trends, and macroeconomic factors affecting the S&P 500.

- User-Friendly Visualization Tools: Transform data into actionable insights with intuitive charts and graphs.

- Banking, Loans, and Insurance Information: Get a holistic view of the financial landscape beyond just stocks.

- Good Cryptocurrency Coverage: As digital assets like Bitcoin and Ethereum increasingly influence traditional markets, Fintechzoom SP500 keeps you informed about their potential impact on S&P 500 companies.

- Community Engagement: Learn from and share insights with other investors through forums and discussion boards.

Read This Post: Which Of These Technological Advances Has Improved …

Benefits of Fintechzoom When Investing in SP 500

Fintechzoom SP500 offers several key benefits for investors:

- Data-Driven Decision-Making: By providing comprehensive, real-time data and analytics, Fintechzoom SP500 helps investors make more informed decisions based on facts rather than emotions or hunches.

- Diversification Strategies: The platform’s sector analysis tools can help investors build well-diversified portfolios across different industries represented in the S&P 500.

- Educational Resources: From beginner guides to advanced strategy articles, Fintechzoom SP500 helps investors continually improve their skills and knowledge.

- Customization Options: Tailor your dashboard, alerts, and analysis tools to focus on the metrics and companies that matter most to your investment strategy.

Step-by-Step: Investing in SP 500 Companies with Fintechzoom

Here’s a practical guide to using Fintechzoom SP500 to enhance your investment strategy:

- Remain Informed:

- Set up your Fintechzoom SP500 dashboard to display key market indicators.

- Configure alerts for significant price movements or breaking news about S&P 500 companies.

- Create Your Watchlist:

- Use Fintechzoom SP500’s screening tools to identify potential investments based on your criteria.

- Add promising stocks to your watchlist for easy monitoring.

- Participate in Discussions:

- Join Fintechzoom SP500’s community forums to share insights and learn from other investors.

- Participate in discussions about market trends, company performance, and investment strategies.

- Review Visualizations:

- Regularly check Fintechzoom SP500’s charts and graphs to spot trends in sectors or individual stocks.

- Use these visual tools to validate your investment hypotheses or identify new opportunities.

The Future of Fintechzoom SP500

As technology continues to evolve, so too will Fintechzoom SP500. Here are some innovations we might expect in the near future:

- Personalized Investment Solutions: AI-driven algorithms could provide tailored investment advice based on your goals, risk tolerance, and market conditions.

- Expanded Educational Services: Virtual reality (VR) tutorials or gamified learning experiences could make understanding complex financial concepts more engaging and accessible.

- Advanced Data Analytics: Machine learning models could predict market trends with increasing accuracy, giving investors unprecedented foresight.

- Integration of Blockchain and Cryptocurrency: As digital assets become more mainstream, Fintechzoom SP500 could incorporate deeper analysis of how cryptocurrencies and blockchain technology impact S&P 500 companies.

- Global Expansion: While focused on the U.S. market, Fintechzoom SP500 could expand to provide similar tools for other major global indices.

Fintechzoom SP500 vs. Traditional Investing Tools: A Comparison with the Dow Jones

While both the S&P 500 and the Dow Jones Industrial Average (DJIA) are important stock market indices, they differ in several key ways:

| Feature | S&P 500 | Dow Jones Industrial Average |

| Number of stocks | 500 | 30 |

| Weighting method | Market capitalization-weighted | Price-weighted |

| Sector representation | Broad | Limited |

| Calculation complexity | More complex | Simpler |

| Historical data | Since 1957 | Since 1896 |

Fintechzoom SP500 focuses primarily on the S&P 500 due to its broader representation of the U.S. economy. However, the platform also provides tools to compare S&P 500 performance with other indices like the DJIA, offering investors a comprehensive view of the market.

Conclusion: Elevating Your Investment Strategy with Fintechzoom SP500

In the ever-evolving world of finance, staying informed and making data-driven decisions is crucial for investment success. Fintechzoom SP500 offers a powerful suite of tools to help investors navigate the complexities of the S&P 500, one of the most important stock market indices in the world.

By leveraging real-time data, comprehensive analytics, and user-friendly visualizations, Fintechzoom SP500 empowers investors to:

- Make more informed investment decisions

- Develop effective diversification strategies

- Continually educate themselves about market trends and investment techniques

- Customize their approach to align with their unique financial goals

As we look to the future, the integration of advanced technologies like AI, blockchain, and VR promises to make Fintechzoom SP500 an even more powerful ally for investors. Whether you’re a seasoned professional or just starting your investment journey, Fintechzoom SP500 provides the tools and insights you need to navigate the dynamic world of U.S. stocks.

Remember, while Fintechzoom SP500 is a valuable resource, it’s always important to do your own research and consider consulting with a financial advisor before making significant investment decisions. With the right tools and knowledge, you can confidently pursue your financial goals in the exciting world of S&P 500 investing.